Working as international business consultants we are increasingly exposed to Farmpreneur businesses who are taking modern approaches to selling and marketing their valued added branded food and beverages, creating value from farm to table through direct marketing their produce from paddock to plate. So, what, this is not new I hear you say? Been happening for some time, has it not? Ever heard of a farmers’ market? How does it affect me anyway, as a consumer or a customer (retailer or foodservice operator)?

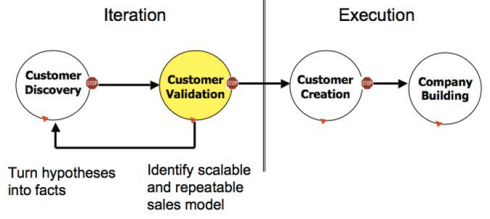

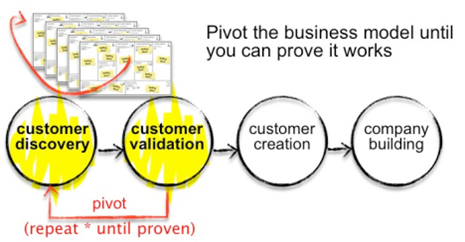

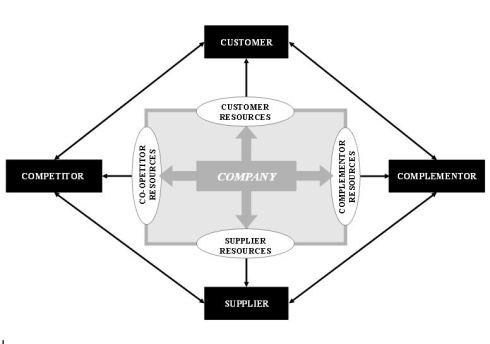

The transformation of agricultural and food and beverage supply chains has been brought about by a multitude of factors colliding to create the perfect conditions for farmers to become Entrepreneurs or Farmpreneurs as we like to call them at Creatovate. Value creators in the supply chain from inputs to outputs predominantly by direct selling and marketing their own “branded” products directly to customers (retail and foodservice) and in some cases direct to consumers as well.

Before we go dive deep into some of the factors contributing to the rise of the “farmpreneur” let us look at some live working examples of these new economy farm to table business models and how you might be able to apply this learning to your own farm, business, brand, customers and consumers.

Gladfield Malt

http://www.gladfieldmalt.co.nz/about-us/#our-history

Doug & Gabi Michael are fifth generation malting barley growers and first-generation maltsters situated on prime agricultural land on the Canterbury Plains of New Zealand. After many seasons growing and harvesting the best malting barley possible, they grew tired of working harder year after year to increase their barley yield only to have their farm gate price per Tonne of malting barley produced drop due to only having one real option to sell their malting barley – one very large multinational malting company. The Michael Family decided to take the challenge/opportunity head on and plunge into the malting industry on their own adding value to their premium quality barley by malting it on their farm and selling it directly to the rising tide of Kiwi craft brewers. Over the next decade, and after a lot of blood, sweat and tears and significant capital investment in plant, equipment, laboratory and people and processes they are now very proud owners of one of Australasia’s leading malting companies with customers from New Zealand to Australia and China and a strong growing demand for their high quality premium craft malts from brewers and distillers worldwide.

Crosby Hops

https://crosbyhops.com/the-farm/about-us/

Transplant yourself 7,000 miles across the great Pacific Ocean to Oregon in the Willamette valley at the foot of the Cascade mountains in the Pacific Northwest of the United States and you will find 5th generation hop growers and first-generation hop merchants, dealers and processors of quality craft Hops – Crosby Hops. Traditionally growing hops for large third-party merchants or grower co-operatives Crosby Hops and the Crosby Families took the brave decision 100 years on from first starting their hop farm to break away from the traditional grower only business model and started selling their hops directly to local craft brewers like Deschutes in Bend, Oregon. Starting initially with freshly dried whole hops Crosby Hops then moved quickly to design and install their own pellet mill with different processing dynamics suited specifically for the unique needs of the rising tide of craft brewers in the USA and the rest is history. Again, after many years of significant investment in processing technology, capital, people, processes, laboratory and direct to brewer customer service Crosby Hops has not only retained their premium status as a grower of quality hops but is now also seen as a trusted merchant for sourcing from other farms and processing their hops and securing supply of unique hops to keep craft brewers abreast of the modern craft beer drinkers needs.

The Chia Co

https://thechiaco.com/au/our-story/

John Foss Founder and Chairman of the Chia Co set out in 2003 to sustainably grow process and market Chia Seeds and Chia based consumer products to the world to achieve the company mission to make a positive contribution to the health and wellness of the global community. A fourth-generation wheat farmer in the Kimberly, John was not happy with two things from growing wheat – 1st – the returns and 2nd – seeing where his high-quality wheat was going and how it turned up on the kitchen table in overly processed sugar added breakfast cereals, baked goods and the like.

With a passion, for the land and the health and wellbeing of his community John saw a unique opportunity to grow and value add to an ancient Chia seed traditionally associated with Mayans and Incas and at the time only available in a sporadic supply from South America. The unique microclimate of the Northern Kimberley region combined with the farming know how of John and his fellow farmers in the region enabled them to perfect growing a consistent quality clean and nutritious Chia seed that is now supplied to major food processors, retail customers, and foodservice operators globally.

The Chia Co in addition has launched their own range of premium plant nutrition products featuring Chia from whole cleaned Chia Seeds to Chia Pods® to Oats + Chia and Chia Breakfast and Salad Boosters and Chia Oil and Flour. The Chia Co now boasts customers across the globe and has offices on three continents in Melbourne, New York and London. The Chia Co is a truly global enterprise exporting to over 35 countries with a vertically integrated and value adding business model every step of the way from the farm to the supermarket shelf and back again.

Heartland Potato Chips

http://www.heartlandchips.co.nz/

Raymond Bowan is not your average potato farmer – far from it he is the epitome of a farmpreneur from the young age of 18 growing his own potatoes and selling them direct to a local fish and chip shop! Furious at a large multinational that purchased to scrap the local potato chip factory which Raymond was a key supplier, Raymond took it upon himself with the support of his family to purchase the remaining shell of a deserted factory, fly to the other side of the world and invest in the latest European frying technology and install a state of the art modern potato chip factory literally in the shell and remains of a multinational snack company’s throw away.

The Bowan family ability to grow their own quality potatoes and supply them to their own factory and have them processed in under 12 hours from picking using state of the art technology has given Heartland Potato chips a quality difference from day 1 and customers (retailers and foodservice) and consumers love them! The rest is history as they say, and the business continues to grow from strength to strength on the back of an authentic story, a proud and passionate family and workforce that looks after everything from farm to supermarket shelf and back again. Heartland Potato Chips has an adoring tribe of customers and consumers on social media who cannot get enough of the chips from the Heart of the South Island, New Zealand.

Five Factors contributing to the rise of the Farmpreneur

1. Farmers’ Markets

Admit it! Who doesn’t love a trip to the market? Its in our DNA! What do we do when we travel to far flung places or dare I say it the third world tourist destinations? Head to the market of course! Why? We love the dynamics of the marketplace, the hustle, bustle, banter, haggling and freshness of the produce and the direct interaction with growers and stall owners. Well the good news for growers is the farmers market is on the rise again!

2. Family Matters!

No doubt you too can see in the shops or in your pantry some fantastic family owned farmpreneur brands that not only taste great but feel great to support. After all what family doesn’t want to help another family in need. It feels good to buy from a family you can empathize and connect with as a consumer and customer. We all love brands, but it is a little harder to say we love corporations unless of course you are a shareholder in them!

3. Co-ops are Crumbling!

Farmer Co-operative business models are crumbling due to their relentless focus on highest volume lowest cost production vs. value adding branded differentiation business models which results in a price race to the bottom. Many Co-ops grow over time and are committed to taking every litre of milk or grain or seed from their grower owners and will clear them at any cost and aim to process them at the lowest possible cost at all costs! We need look no closer to home than a local dairy co-op now in family hands after a strategy that focused on scale and cost of production cutting at the expense of branded differentiation and value adding. Net result = fail = sale!

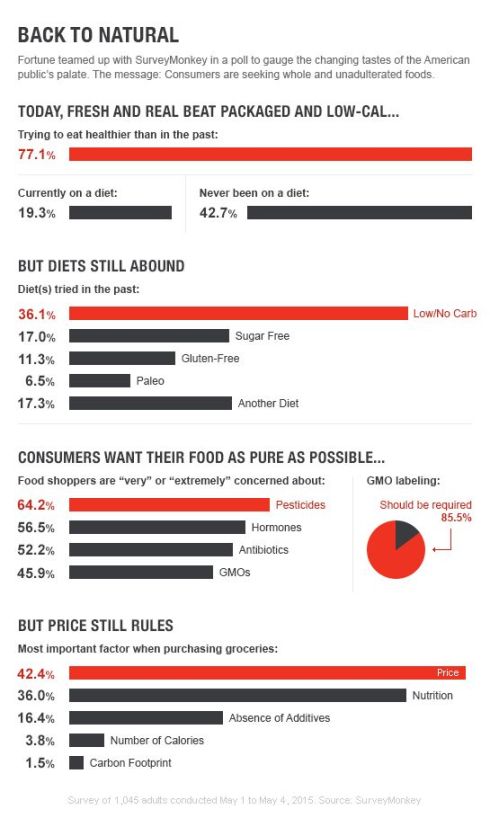

4. Consumer Trust Drops

Consumer trust with leading large food multinationals is at an all time low as they read about tax minimisation, restructuring or harsh treatment of growers on the land. Consumers are reading labels more than before, they are finding things out on social media they never knew about that happen behind the scenes in the relentless drive to meet margins, or retailers demands. Put simply the behaviour of the world’s largest companies on the supply and retail side doesn’t sit right with a lot of consumers today. How can they react? Can they change the system? Probably not, but they can vote with their wallets and buy family or locally grown or owned where they can afford to and in many cases that starts in their grocery basket!

5. Going Direct to Customers and Consumers

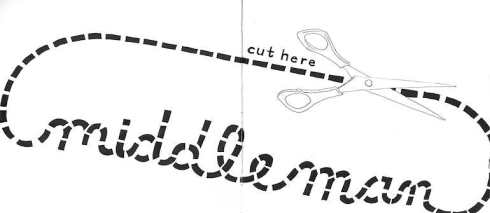

Growers, producers and food manufacturers can go direct to customers and consumers like never. Retailers are ready and actively sourcing local brands for local customers. Farmers markets appear in abundance as a great way for growers and consumers to interact directly. Social media and internet marketplaces and platforms from Facebook to eBay to Amazon or Alibaba or TMall afford the opportunity for growers to grow, process, brand and ship directly to consumers from farm to table. While distributors will also add value in terms of aggregation of many small customers or many small volume products dropped and delivered on a single truck to a seller or buyer there is more and more pressure than ever before to cut out the middleman and modern technology and tools of the trade like e-Commerce and hyper fast logistics are facilitating this transition faster than ever before.

In conclusion, simply put it feels good as consumers to support a farmer and family owned business no matter how small they are today or tall they become tomorrow. If their values and the values of their branded products align with our own as consumers, we actively seek them out in preference to the brands of faceless corporations. We take pride in sharing our latest pantry treasures at dinner parties, BBQs or with our friends on Facebook and Instagram. We take it upon ourselves as consumers and upholders of social justice to help the farmers, other families fight against the behemoth corporations. Five factors are strongly aiding those farmers and families to take ‘entrepreneurial risk’ and create new value adding business models. Look out in years to come as we see many more cases in our own backyard or country rise from the soil and land on our supermarket shelves.

Dermott Dowling is Managing Director of Creatovate International and Innovation Consultancy. Creatovate specialise in helping clients create value through the twin pillars of International Business Development and Innovation. We believe in the power of sustainable organic growth and using choice-based strategy to clearly articulate where your business is going, how you will get there and when and what resources you will need to deploy to make it happen! If you are interested in a no obligation face to face or telephone chat, please do not hesitate to reach out to us anytime.For more information on our learning and methodologies head over to our website at www.creatovate.com.au and sign-up for our blog at CreatoBlog

Bibliography & References:

ESTHER ASHBY-COVENTRY (2017) Heartland may employ more staff to cope with growing range of chips February 21, https://www.stuff.co.nz/timaru-herald/news/89630153/heartland-may-employ-more-staff-to-cope-with-growing-range-of-chips viewed on 9/02/2018.

Blake Crosby (2013) A Hop Farmer’s Diary: 30 days in the life of Oregon’s Crosby Hop Farm, Aug 19 https://www.craftbrewingbusiness.com/ingredients-supplies/a-hop-farmers-diary-30-days-in-the-life-of-oregons-crosby-hop-farm/ viewed on 09/02/2018.

Clare Dunn (2015) Is chia the next quinoa? Local growers are positioning themselves to be at the head of the next superfoods trend. The Sydney Morning Herald, May 25, http://www.smh.com.au/small-business/growing/is-chia-the-next-quinoa-20150514-gh1mb2.html viewed on 9/02/2017.

Keith Gribbins (2017) Hop insights: We discuss the rise of Oregon Comet, the slowing of Cascade, Crosby Hop Farm and rock bands with Blake Crosby https://www.craftbrewingbusiness.com/featured/hops-insights-discuss-rise-oregon-comet-slowing-cascade-crosby-farm-rock-bands-blake-crosby/ April 24, viewed on 22/01/2018.

Abbie Napier (2014) Turning Risky Start-Up into Success The Press, Sep 7, http://www.stuff.co.nz/the-press/business/10467259/Turning-risky-start-up-into-success viewed on 09/02/2018.