Concept of small business running fast!

Is it just us or does it seem today that the small food companies are moving faster than ever before and the big companies are moving more slowly when it comes to innovation in our local food industry? Perhaps you and I are not alone in our thinking? The literature and newswires in the US have been awash with stories of “the war on big food” (Kowitt, 2015) with big bold claims like “big food is under attack from the rise of startup granola!”

Changes are not only taking place abroad in the US supermarket aisles where shoppers are cruising the periphery of the store seeking out new and trendy, authentic and unique chilled, fresh, natural and healthier food options. The same trends are evident in Australia and plain as daylight for all to see on the high street where the Fast Food Evolution has seen global super brands like McDonalds, KFC, Subway, Pizza Hut and Burger King scrambling to reinvent themselves against the rising tide of ‘fast, casual dining chains’ like Grill’d, Nando’s and Mad Mex (Brown & Han, 2015). Let’s not even start a conversation about the global food truck trend that could be today’s incumbent fast food operators tomorrow’s ‘disruptor’.

VIDEO: Can big food and beverage think like a startup?

Big food companies will need to rethink their business models if they want to innovate like startups, according to Dermott Dowling, managing director of innovation and international business consultancy Creatovate.

Speaking recently at the Food & Drink Business Disruptive Innovation LIVE forum, he explained why this is growing in importance, and how some of the world’s largest food and beverage companies are responding.

According to Dowling, the top 25 food businesses in the US lost at least $4bn in market share last year as consumers skipped the core food aisles in favour of the fresh segments, and increasingly sought out innovative products from smaller companies.

In this video clip, Dowling describes how some of the world’s largest companies, including Nestle and Coca-Cola, are responding to the movement, and he shares some examples of local companies that are having a go at digital disruption in the food space. See the full clip here.

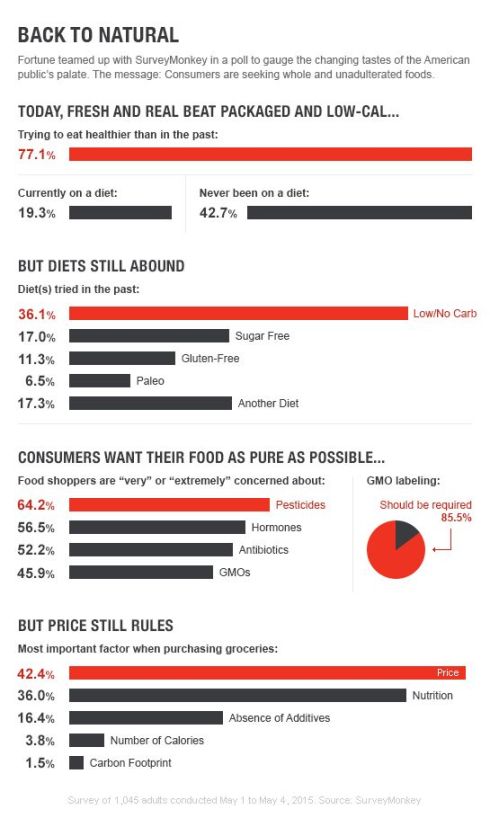

Why is this happening all of a sudden? Is it another off-shoot of the start-up tech trend finally finding its way into the food industry? Like most complex issues of business today it is a symptom of a number of factors and key influences colliding to create the perfect storm for “disruptive innovators” in the food industry. Let us start with the trends underlying today’s shopping decisions consumers are making today with their wallets – after all is it not the shopper who ultimately controls the marketplace nowadays?

- Shoppers and consumers are looking for ‘authenticity’ and ‘realness’ more than ever before. Their trust in global multinationals is at an all-time low and most major food companies operating in Australia are global multinationals http://www.slideshare.net/dowlmott/going-global-in-food-grocery-retailing-business . With a smart phone in every shoppers pocket the truth is out there on Facebook, Instagram and Twitter and consumers trust their friends and followers and influencers’ more than super brands blasting the old mass media airwaves. Hirschberg (2015), founder of Stoneyfield Organic Farms sums it up when he says “There’s enormous doubt and scepticism about whether large companies can deliver naturality and authenticity.” As a result consumers are more connected with small and medium size family owned or startup food businesses and brands. They feel a closer affinity with the founders than the boardrooms and polished CEO communicators of “Big FoodCo”. They connect through their social media accounts, love the storytelling of startup founders and the authenticity of the founder(s) stories up all night packing boxes in their garage or cooking new prototypes on their stovetop before racing to the local farmer’s market or grocery shop on their way to fame and fortune.

2. Mintel (2015) Trends report highlights front, bold and centre Trend #3 Less processed foods, more natural as consumers continue to be concerned with eating natural and ‘less processed’ food products.

3. Consumers and shoppers are more affluent than ever before and yet more sporadic in their shopping and buying behaviour. They fill their trolleys with private label staples and shop at Aldi and CostCo to save on essentials and then simultaneously splash out on their indulgent luxury food treats. They love sharing their discoveries at their local high end speciality independent grocery store or Asian specialty shops with friends and taking something a little unique and special over to their neighbours or friends place for dinner to start a ‘foodie’ conversation. Again here the shopper leans towards the ‘smaller, more real, and authentic’ food brands.

There are also a few key influences in the background from broader business theory on innovation that are impacting the ability of the smaller and medium size companies to grow faster than ever before and hindering the larger elephants from dancing the same jig when it comes to innovation.

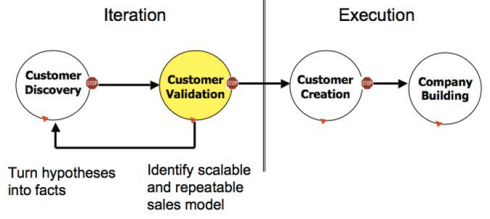

Customer Development Model (Blank & Dorf, 2012)

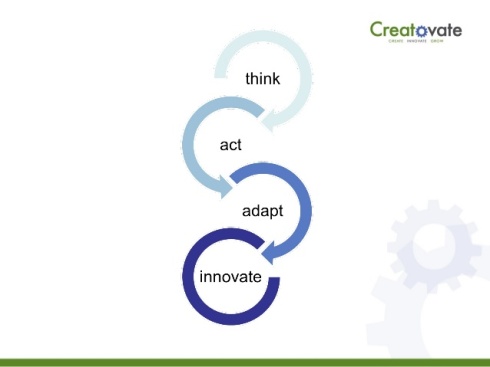

- Small and medium size companies by their very nature are ‘searching for growth’ ‘new business models’ and ‘repeatable and scalable business models’ and most importantly they are actively seeking out ‘new customers’. As they seek out new growth pathways for their businesses they discover unmet customer needs and wants, gaps in the market and they scurry back to the lab or pilot plant or co-manufacturer and whip something up quickly in the ever desperate search for sales and a repeatable scalable business model. With those real sales comes learned experience what’s working, what’s not, what needs fixing and so the cycle continues at pace – Build, Measure, Learn or as we like to say @creatovate “earn & learn”. Less time in research more time spent doing, making, talking to customers and consumers with real prototypes, failing, learning, earning, and eventually success! $:-)

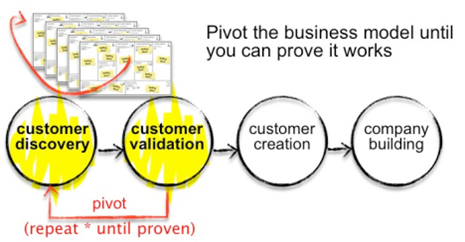

Business Model Iteration (Blank & Dorf, 2012)

2. Being smaller by nature you are in fact at a strategic advantage when it comes to innovation. Less $/people/time makes you smarter in your choices, you look for fast hacks forward, cut corners and try to make more from less without the bureaucracy of Stages and Gates and internal meeting after internal meeting and research after research spending valuable $/people/time but earning nothing, spending a lot and often learning very little about real customer and consumer problems in the marketplace.

3. Small and medium size companies lack middle management aka ‘ the innovation police’ who are stringently guided and controlled by budgets, plans, processes, performance reviews and the need for ‘incremental’ over ‘transformational’ growth and innovation. The middle manager’s role is to shepherd the workforce on the annually set KPIs, Manage Budgets and stop people seeking out opportunities off the strategic plan no matter how promising those opportunities might look or feel to the front line.

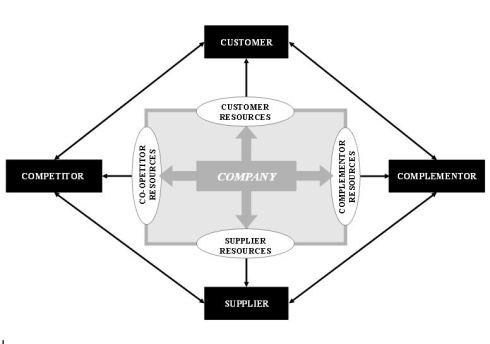

Resource Dependency Model

4. Stakeholder dependency theory (Hillman, et al 2009) suggests any organisation is interdependent on its ecosystem and the biggest interdependencies on any organisation are its ‘customers’ and its ‘shareholders’. Think about who the dominant customers are of a small or medium size food enterprise in Australia vs. a large one? Think about what investors are seeking in small and medium size business? Fast growth? Exits? Vs. Large stable food businesses? Safe and consistent returns?

Technology and capital are influencers in the background and technology enables the small and medium companies to better connect with their consumers, levels the playing field in terms of ability to interact professionally with customers (retailers) and trade partners. Capital seeks growth opportunities and will look for the opportunity to enter and exit as quickly as possible where the opportunity for disruption exists. Are we likely to see the small and medium growth food companies grow faster into the future – most definitely Yes! Will the large incumbents sit back and watch the ants eat their cake? That remains to be seen and we are in for an exciting food future ahead.

Dermott Dowling is Managing Director @Creatovate, Innovation & International Business consultancy. Creatovate help businesses create, innovate and growth through sustainable innovation processes and spreading their wings outside their home base.

References:

Blank, Steve & Dorf, Bob (2012) The Startup Owner’s Manual K&S Ranch Inc, California, US. First Edition.

Dowling, D (2015) Think! Act! Adapt & Innovate $ like a Startup! http://www.linkedin.com/pulse/think-act-adapt-innovate-like-startup-dermott-dowling?trk=prof-post LinkedIn, Aug 19, retrieved on 05-Nov-15.

Dowling, D (2015) Putting “I” first in Insight to Innovation http://www.linkedin.com/pulse/putting-i-first-insight-innovation-dermott-dowling?trk=prof-post LinkedIn, Feb 25, Retrieved on 5-Nov-15.

Dowling, D (2012) Globalisation of Food & Beverages http://www.slideshare.net/dowlmott/going-global-in-food-grocery-retailing-business Slideshare, Retrieved on 5-Nov-15

IRI Worldwide (2012) The Pacesetters Report http://www.iriworldwide.com/iri/media/iri-clients/4-17-13T_T%20April%202013%20NPP%20vFinal.pdf viewed on 5-Nov-15.

Kowitt, Ben (2015) The War on Big Food http://fortune.com/2015/05/21/the-war-on-big-food/ Fortune Online 21 May, retrieved on 5 Nov. 15

Brown, R & Han, E (2015) Fast Food Evolution – Global Super brands are having to reinvent themselves to keep up The Sydney Morning Herald online 11 January http://www.smh.com.au/nsw/fast-food-evolution–global-superbrands-are-having-to-reinvent-themselves-to-keep-up-20150106-12j7mc.html retrieved on 05-Nov-15

Australian Food News (2015) Top Global Food and Drink Trends for 2015 http://ausfoodnews.com.au/2015/10/21/top-global-food-and-drink-trends-for-2016.html October 21, retrieved on 05-Nov-15.

Amy J. Hillman, Michael C. Withers and Brian J. Collins R (2009) Resource Dependency Theory: A Review Journal of Management 2009 35: 1404 originally published online 23 September 2009 https://www.unifr.ch/intman/assets/files/Teaching/Network_2014/Additional%20Readings/Hillman-Withers-Collins%202009%20-%20Resource%20Dependence%20Theory.pdf retrieved on 5-nov-15

Sue Mitchell (2015) Here’s Why Consumers are Choosing Aldi over Woolworths and Coles http://www.smh.com.au/business/heres-why-consumers-are-choosing-aldi-over-woolworths-and-coles-20150714-gicgix.html July 15 retrieved on 04-Jan-16.